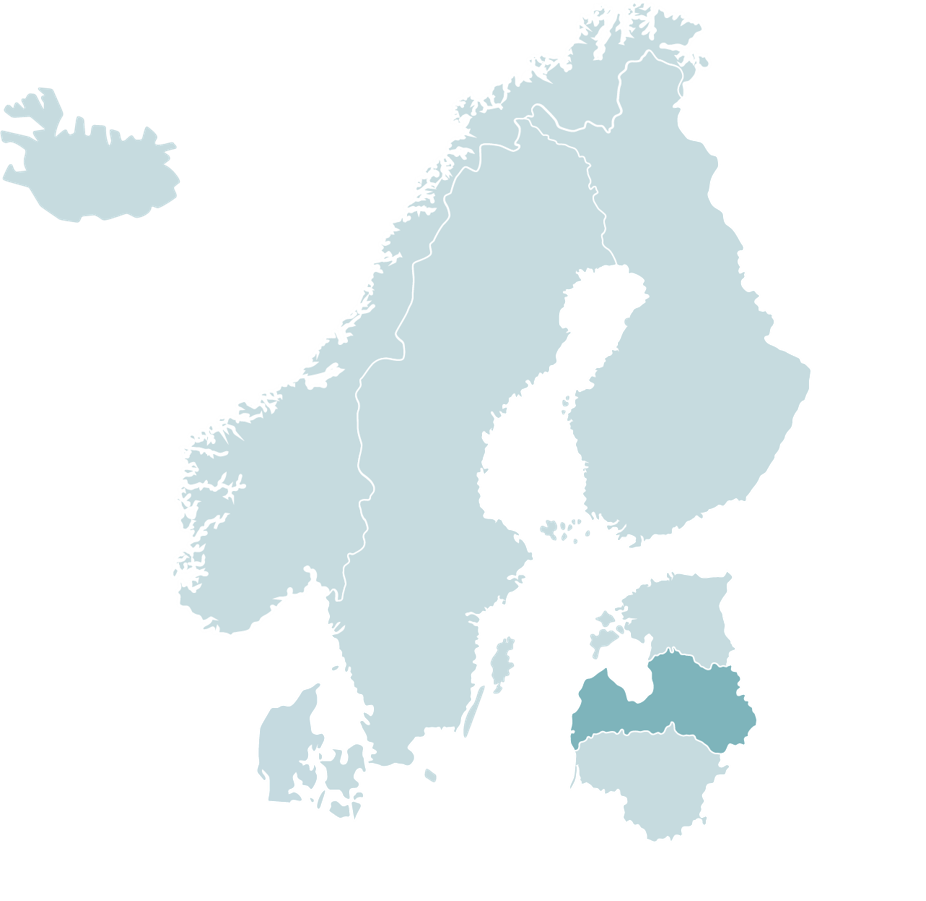

Latvia joined NIB in 2005 with the other Baltic countries. In 2023, NIB opened a new office in Riga to bring the Bank closer to its Baltic stakeholders. Some of NIB’s latest financed projects in Latvia are Rigas Siltums’ and Latnevergo’s investment programmes, Preses Nama kvartāls developments, and the Ķekava bypass road project.

Start of operations: 1995

Projects financed: over 125

Amount financed: over EUR 1.6 billion

In recent years, NIB has financed infrastructure, energy and transport projects in Latvia, mainly supporting companies in the public sector.

Looking ahead, NIB’s strategy will pivot more towards a stronger focus on the green transition and collaboration with privately owned companies.

Authorised capital

Member country | Rating* | Authorised capital | Country’s share |

| Denmark | Aaa/AAA | 1,763,074,493.79€ | 21.1% |

| Estonia | A1/A+ | 76,651,259.81€ | 0.9% |

| Finland | Aa1/AA+ | 1,482,690,785.19€ | 17.7% |

| Iceland | A2/A+ | 79,132,913.42€ | 0.9% |

| Latvia | A3/A | 111,830,807.21€ | 1.3% |

| Lithuania | A2/A | 163,231,714.80€ | 2.0% |

| Norway | Aaa/AAA | 1,799,704,941.30€ | 21.5% |

| Sweden | Aaa/AAA | 2,892,527,558.59€ | 34.6% |

| Total | 8,368,844,474.11€ | 100.0% |

Latest loans

Latest articles

Contact us

Kaspars Piladzis

Country Lead for Latvia

+358 10 618 0391

Vytautas Brazaitis

Senior Communications Officer

+358 10 618 0235