Lending products

NIB offers complementary long-term financing, sector expertise and a quality stamp for your project. Our lending products include corporate and sovereign loans, loans to municipalities, loan programmes to financial institutions, sustainability-linked lending as well as investments in labelled and MREL-eligible bonds.

Lending products:

Project loans

In a project (use-of-proceeds) loan, the borrower uses the funds for a specific purpose, as agreed between the client and NIB. Project loans constitute the majority of NIB’s lending operations.

Sustainability-linked loans

Sustainability-linked loans (SLL) are connected to key performance indicators and targets set in close dialogue with our customers between NIB and the customer. SLLs are aligned with a corporate strategy and create financial incentives for companies to step up their climate efforts. For instance, our borrowers may enjoy lower margins if the set sustainability targets are met.

Uncommitted credit facilities

Uncommitted credit facilities (or framework agreements) provide our public sector customers with the flexibility to request loan offers at short notice. We agree with the customer on the scope of the financed investments and the key credit terms in the Framework agreement. Based on a signed Framework agreement, NIB can make tailored loan offers to meet customer’s needs.

All loans undergo NIB’s project assessment, sustainability and ESG review before financing is granted. We follow up after the project completion and report on the set indicators for impact on productivity and environment. We monitor the customer’s sustainability performance against the pre-defined key performance indicators.

We invest in labelled bonds (green bonds, social bonds, sustainability bonds and sustainability-linked bonds) and commercial papers to complement ordinary lending and support capital market development.

Furthermore, NIB invest in MREL (minimum requirement for own funds and eligible liabilities) eligible bonds offered by Nordic and Baltic financial institutions to support them in SME lending.

Our loan programmes are used for on-lending through financial intermediaries. Projects and investments financed through a financial institution shall also fulfill our mission to improve productivity and / or benefit the environment.

We can support you with risk identification and mitigation, due diligence, loan structuring, and transaction negotiation in complex financial structures. Our project & structured financing offering includes:

- non- and limited-recourse project financing

- structured loans for complex financing and leveraged borrowers

- private public partnership (PPP) financing

Borrower types:

Corporate project loans in NIB’s member countries constitute the main part of NIB’s lending activities in terms of volume.

By offering sustainability-linked loans, we also support the corporate transitions of our clients.

Sovereign loans can be granted as a direct loan to a government.

Furthermore, we provide committed and uncommitted credit facilities for regional or local governments.

Through financial intermediaries, we finance SMEs and small mid-caps. Our loans can be used to finance both tangible capital as well as related working capital with tenors of at least one year.

We can also engage in risk-sharing facilities with local financial institutions as well as invest in MREL-eligible bonds.

We also finance investments outside of the Nordic-Baltic region. A member country interest in the project is a prerequisite for such loans.

Frequently asked questions

Can a private person apply for a loan from NIB?

No, NIB does not offer loans to private persons.

What kinds of projects do you finance?

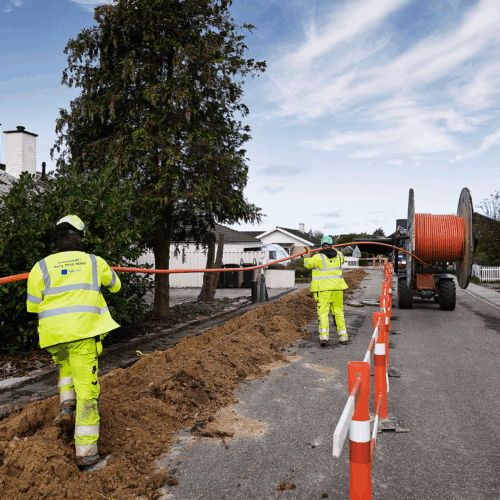

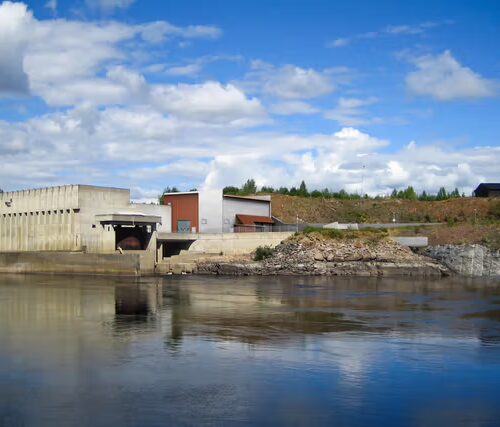

We provide long-term loans to public- and private-sector clients. The financing aims to improve productivity and benefit the environment of the Nordic and Baltic countries. This includes investments in cleaner energy and transport, research and development, supporting climate change mitigation, and expanding production capacity. Financing for small businesses is channelled through intermediaries.

Where do you operate?

Most of NIB’s financing operations are in the Nordic–Baltic region. Outside the membership area, projects financed by NIB should be of mutual interest to the country of the borrower and our member countries.

We may extend loans in countries that have signed agreements on financial cooperation with NIB. In certain cases, loans may be provided in other OECD countries.

What are NIB’s eligibility criteria?

We assess all our potential loans for productivity gains and environmental benefits, in accordance with NIB’s mandate and eligibility criteria.

Where can I find the loan application form?

There is no standard form for a loan application. Contact our lending team, and we will tailor our financing offer to match your needs.

Supporting corporate transitions

Sustainability-linked loans focus on our customers’ forward-looking commitments related to agreed key performance indicators, creating financial incentives to meet their sustainability targets.

Fostering capital markets

We invest in bonds to complement ordinary lending and support the development of the capital markets.

Latest loans

Explore more

NIB and InvestEU

We can further mobilise private investments for the green and digital transitions.

Project assessment

We assess all our financed projects for productivity gains and environmental benefits.