9 Feb 2016

Oil price: How does it affect Norway and the rest of the region?

by Kyrre M. Knudsen, Chief Economist at SpareBank 1 SR-Bank, Norway

The correlation between oil prices and the Norwegian economy may not be quite as clear-cut as many believe. A low oil price is positive for the global economy and therefore has significant positive impacts on the Norwegian economy, as well as those of other countries in the Nordic Baltic region.

How important is the oil price for Norway?

Initially, it is tempting to believe that Norway is an oil-driven economy. Oil prices mean a lot for Norway, both for the income of the oil sovereign wealth fund and jobs in the oil industry. Lower oil prices and oil activity is therefore negative. Oil wealth erodes. Many lose their jobs. Unemployment increases.

So far so good—however, the correlation between oil prices and the Norwegian economy is still not quite so simple.

Firstly, it is important to recall that this relationship may not be as strong—even in the short term—as one might think. Take 2015 as an example. Oil prices more than halved, but the Norwegian economy still managed fairly well. Statistics Norway estimates growth was 1.5% for mainland Norway, which was only slightly lower than the two preceding years, so weakening was far less than for some other commodity-based economies. In Russia, Brazil and Venezuela, GDP fell by 3-5% in 2015. Canada, slightly reminiscent of Norway, is doing somewhat better, with growth of nearly 1%.

Secondly, many other factors come into play. Let me first briefly point out that low oil prices trigger supportive mechanisms for the Norwegian economy. A weak exchange rate, low interest rates, increased public spending and corporate restructuring towards less petroleum-intensive sectors are all examples of these mechanisms. So, on to my main point: Norway is very much influenced by how the global economy performs.

Norway is a small open economy—the world economy is essential

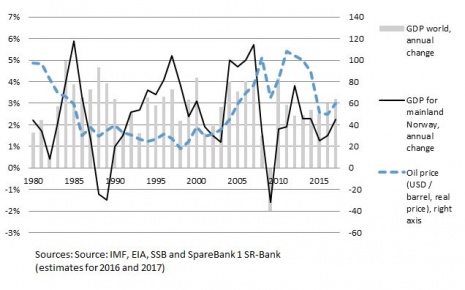

Norway is a small open economy. The graph below illustrates that the performance of the global economy probably is of greater importance than the oil price. Development in the 1990s illustrates this. Oil prices were low throughout much of the 90s (between USD 20 and 40 per barrel converted at the current dollar value). The Norwegian economy however performed well in the 1990s. The close relationship between the world and Norway becomes even clearer if we look at the 2000s.

Growth slowed globally and in Norway in the early 2000s. Golden years of solid growth followed in 2003–2007. Thereafter, the global financial crisis had severe implications for Norwegian economic growth. In more recent years, connection between growth in Norway and in the world remained fairly close.

For 2016 (and subsequent years), how the world economy develops is of vital importance for the Norwegian economy.

What to expect for 2016?

To say something tangible about Norwegian economy in the coming year, we must have some thoughts about how the world will evolve.

After four years of growth in the world that has been slightly lower than the historical average, we and other forecasters (IMF and OECD et al.) expect that there will be somewhat higher growth in the world in 2016. Slightly lower growth in China is offset by improvement in the US, Europe and emerging economies.

This is good news for Norway and the rest of the Nordic-Baltic region. Better development in the world is positive for the Norwegian economy. The weak Norwegian exchange rate reinforces this positive effect. This counteracts the decline in oil.

On this basis, we estimate that the Norwegian economy will grow by nearly 1.5% in 2016 and then up to about 2% in 2017. Other forecasters such as, for instance, Statistics Norway, are somewhat more optimistic estimate of 2% in 2016 and 2.3% in 2017. On the other hand, the central bank in Norway is somewhat more sober. They expect 1.1% in 2016 and 1.9% in 2017.

An important reason why many expect better growth in the world in 2016 is the low oil price. A low oil price is positive for all countries that are net importers of oil and gas, and it is indeed most countries in the world. Nearly six out of seven billion people in the world live in such countries.

A lower oil price is positive for the world economy. It is positive for the Nordic-Baltic region. It thus follows that a low oil price even has some positive effects for the Norwegian economy.

Visit SpareBank 1 SR-Bank’s Website for more information (in Norwegian and English)

Kyrre M. Knudsen

Chief Economist at SpareBank 1 SR-Bank, Norway.

Previously: Statoil, Norway’s Ministry of Finance and Central Bank. Mr Knudsen holds a cand.polit degree in economics from the University of Oslo.

Photo: SpareBank 1 SR-Bank