2 Feb 2015

NIB targets EUR 3.5 billion funding in 2015

Jens Hellerup, Head of Funding and Investor Relations at NIB

In 2015, NIB expects to raise about EUR 3.5 billion. As in previous years, the timing of transactions and activities in different markets will play a crucial in for the success of the programme.

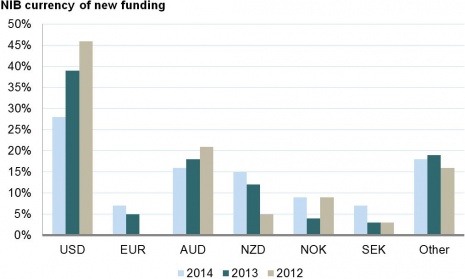

Last year, NIB’s funding totalled EUR 3.4 billion through 35 transactions in ten different currencies. The USD remained the most important funding currency, with a share of 39%. In addition to the regular USD benchmark, in autumn the Bank issued its first USD benchmark-sized NIB Environmental Bond.

USD Benchmark—the cornerstone of NIB’s funding programme

“The USD Benchmark is of great importance for NIB, as it ensures that NIB remains visible to international investors and establishes a pricing reference in the market”, says Jens Hellerup, Head of Funding and Investor Relations at NIB.

Being a successful benchmark issuer is an essential part of NIB’s funding strategy. The Bank conducts careful assessment of timing and maturity for every benchmark it issues. In April 2014, NIB decided to sell a USD 1 billion bond with a five-year maturity.

“We saw a clear window to bring a strong deal to market in the five year segment”, explains Mr Hellerup.

“In 2015, NIB will issue a new USD benchmark and we’ll again face the challenge of picking the right window.”

Green bond programme expanded in 2014

NIB is one of the few supranational organisations with an explicit environmental mandate for its lending, and it is natural for the bank to fund its environmental loans with green bonds—NIB Environmental Bonds.

“In the past, we have successfully issued NIB Environmental Bonds in private placement and in public format in SEK. In 2014, the Bank took the next step and issued a benchmark-sized USD transaction with the aim of selling the bonds to socially responsible investment, or SRI, investors worldwide”, says Mr Hellerup.

A seven-year USD 500 million NIB Environmental Bond was issued in September. This green bond had the longest maturity issued by a supranational at the time of issuance. The order book exceeded USD 800 million, attracting strong demand from investors with an interest in supporting NIB’s loans to eligible environmental projects within their investment mandates.

“This transaction was able to attract a large number of SRI investors. Over a third of the investors in the order book were buying a NIB bond for the first time. We were very happy to see our investor base broaden”, says Hellerup.

NIB plans to continue the green benchmark strategy, complemented by smaller public deals and private placements.

Antipodean currencies—a stronghold in NIB’s funding programme

Over the years, the market for AUD- and NZD-denominated bonds has played an important role in NIB’s funding programme. Last year, about a third of the funding was raised in these currencies. Ongoing demand for long-dated bonds in Australian dollars allowed NIB to increase its long line with a maturity date in 2024 up to a size of AUD 1 billion.

In the Kauri market, NIB is one the most regular issuers. Last year, a new NZD 800 million five-year line was opened.

NIB was voted the Kauri Issuer of the Year 2014 by the readers of Kanganews, a leading capital markets magazine in Australia and New Zealand.

“The Bank has received the award for the second time in a row and the third time overall. This shows the excellent relationship NIB has built with investors and intermediaries in this market”, says Mr Hellerup.

NIB expects to stay active in both markets. In January 2015, the Bank was the first to issue in the Kauri market with a tap for NZD 550 million to an earlier 2020 bond. In the Kangaroo market, a new five-year line with an amount of AUD 300 million was issued.

Closer to home, NIB was active in the Nordic currencies with a total of NOK 2.5 billion and SEK 2.25 billion issued last year. In both currencies, issues were made in the four- and five-year part of the curve and mainly taken up by domestic investors.

“We are happy to issue in Nordic currencies. Many of NIB’s customers in the Nordic countries need loans in the local currencies”, Mr Hellerup explains.

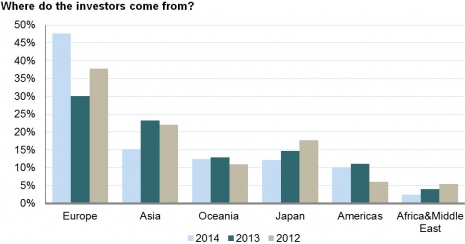

Over the years, European investors have been important for NIB. Almost half of the Bank’s investors in 2014 are domiciled in in this region. Last year, the share of European investors increased, along with European bank treasuries’ demand for NIB’s securities.

Investors from Asia and Japan have always been important for NIB, and in 2014 this was still the case. However, the share is lower than in the past two years. This can be explained by longer maturities not suiting Asian central banks very well during 2014.