26 Nov 2013

NIB attractive for Kangaroo and Kauri investors

While one could think that a story with the words Kangaroo and Kauri in the title might be about a popular Australian animal and a mighty tree species in New Zealand, this article is about bonds issued by foreign issuers in the capital markets of Australia and New Zealand.

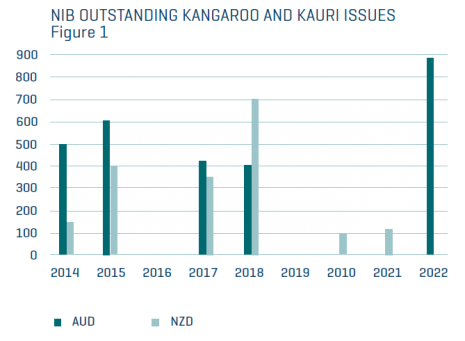

The Nordic Investment Bank is a recognised issuer of AUD and NZD denominated bonds as investors value the diversification and returns they can offer. During the last six years, NIB has issued AUD 3.45 billion in the Kangaroo market and NZD 1.825 billion in the Kauri market, as shown in Figure 1. NIB is the third-largest issuer in the Kauri market both by volume issued and volume outstanding.

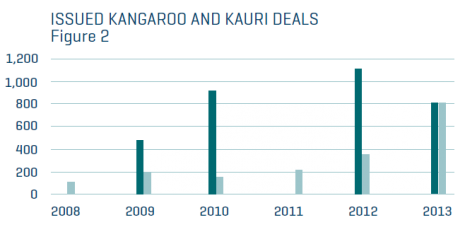

NIB had all in all six maturity lines outstanding in both markets as shown in Figure 2 at the end of October 2013. Of NIB’s total outstanding funding, the AUD and the NZD currencies together represented 18% at the time. NIB is an active issuer in these markets due to the good investor demand.

Investor demand

The investor base for NIB’s Kangaroo and Kauri bonds is quite evenly split between national and international investors. At the end of October 2013, the Australian investor base has bought 39% of the Kangaroo bonds, while investors domiciled in New Zealand has bought 49% of the Kauri bonds. The biggest investor group in both markets are the local bank liquidity portfolios.

The biggest development to the investor base during recent years, has taken place among international investors. More asset managers and central banks have started to diversify into Kangaroo and Kauri markets than before. By the end of October 2013, central banks accounted for 29% of the demand in both markets, and asset managers accounted for 31% in the Kangaroo market and 22% in the Kauri market. Internationally, the demand comes mainly from Asian investors.

Glen Sørensen, Director of Syndicate from ANZ New Zealand, a subsidiary of the Australia and New Zealand Banking Group Ltd., believes the key drivers for growth in the Kauri market are international investors in search of diversification after the financial crises. New Zealand’s relatively robust economy, debt position and high yields make it an attractive prospect for investors.

In addition, the triple-A rated Supranational, Sovereign, Agency (SSA) asset-class-Kauri-issues represent an alternative high quality NZD asset compared to New Zealand Government Bonds (NZGB). And as NZGB supply has been scaled back since peaking following the Canterbury earthquakes in late 2010 and early 2011, spreads to NZGB’s have become more attractive.

Low interest rates and tight valuations versus government bonds in USD and EUR supra-markets, make investments in higher yielding AUD and NZD denominated assets attractive both from an absolute and a relative value perspective.

Investments in currencies other than USD and EUR are increasing, according to a survey of central bank reserve managers published by the International Monetary Fund (IMF) in May 2013. Particularly so-called “commodity currencies” like AUD and CAD are attractive to this investor group.

The IMF Working paper—Survey of Reserve Managers—states that “These commodity currencies may be attractive in their own right but can also function as a proxy for rapidly growing emerging market countries, which are less investable.” Apparently, there is an investment trend, both from a diversification and a return perspective that supports assets denominated in currencies like AUD and NZD.

Kangaroo and Kauri offer diversification to NIB

NIB’s funding team aims to fund the Bank’s lending as inexpensively as possible considering the risk framework. While the main funding currency for NIB is USD, the funding team sees great value in having a diversified funding currency composition in order not to be too reliant on one single market. This is why AUD and NZD are so important in the Bank’s funding programme.

“NIB is one of the pre-eminent names in the Kauri market, with some of the tightest issuance spreads and largest issuance volumes.”

Glen Sørensen

Director of Syndicate from ANZ New Zealand and New Zealand Banking Group Ltd.

Photo: Syndicate

In May 2013, NIB announced it had increased its Kauri issue due 30 January 2018 with NZD 175 million. The total size of the deal was thus brought to NZD 700 million.

“This represents the largest Kauri SSA to settle at the time,” says Sørensen.

NIB has issued AUD and NZD denominated bonds nearly every year since 2006 and 2007, respectively. While NIB has for some years had to pay a small concession versus the USD benchmark pricing, this has been outweighed by the benefits arising from diversification and visibility to investors. The consistency has paid off in years with a favourable pricing versus USD benchmark market and NIB has then been able to profit from its well established access to the Kangaroo and Kauri markets.

Investor marketing

NIB’s Funding and Investor Relations team visits investors in Australia and New Zealand every year. They appreciate first-hand information and the Nordic story is generally well received, even when news from Europe caused serious investor concerns. NIB has also increased its visibility in these countries by frequently participating in roundtable discussions, conferences and seminars.

As the international investor base has become more important, NIB has also started to conduct road shows to reach non-domestic AUD and NZD investors. Since investors have dedicated portfolio managers for different currencies, NIB sees it as important to be more product specific in its marketing efforts.

Attractive future

NIB expects Kangaroo and Kauri markets to remain attractive. Domestic investors value the diversification offered by international issuers like NIB, and international investors value the attractive AUD and NZD currency diversification.

Sørensen says New Zealand’s positive economic, debt and yield drivers look set to continue with the country’s positive soft commodity and Christchurch rebuild stories unfolding after the devastating February 2011 earthquake.

“This is driving five-year NZD swap yields to 70 basis points over the AUD equivalents, versus 100 basis points below less than two years ago,” Sørensen says.

“I hope to see a greater variety of issuers in Kauri format going forward, as has occurred in the Kangaroo market, although this is also a challenge given the NZ-centric mandates many domestic investors face—the AAA SSAs representing a necessary exception for quality,” Sørensen says.

NIB is confident it will remain an active and valuable issuer in the Kangaroo and Kauri market.