We accelerate the transition of our societies

Funding

We acquire the fund for our lending by borrowing on the international capital markets.

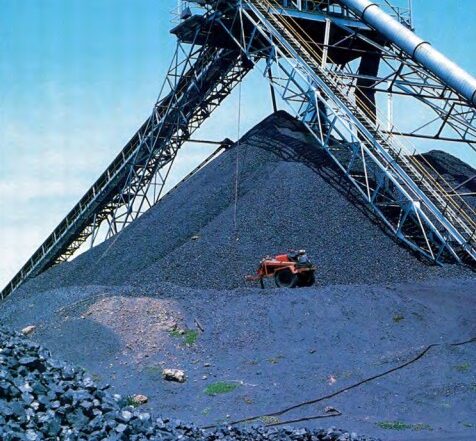

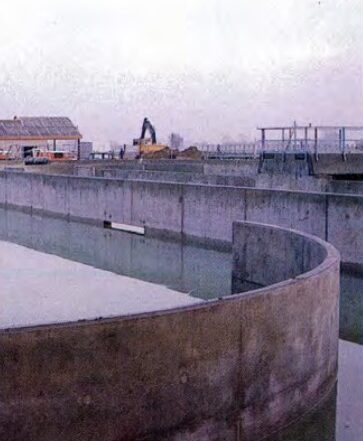

Lending

We provide long-term financing that improves productivity and benefits the environment.

Financing the Future

Our vision is a prosperous and sustainable Nordic–Baltic region.

Ownership and capital

NIB was established on 4 December 1975 through an intergovernmental treaty between Denmark, Finland, Iceland, Norway and Sweden.

On 1 January 2005, Estonia, Latvia and Lithuania became members of the Bank.

NIB’s authorised capital amounts to approximately EUR 8,369 million. Our member countries have subscribed the authorised capital according to a distribution key based on the eight member countries’ gross national income.

The authorised capital consists of paid-in capital and callable capital. About 10.10% of the subscribed authorised capital stock is paid in. The remainder of the authorised capital consists of callable capital, which is subject to call if the Board of Directors deems it necessary. In addition to the paid-in and callable capital, the Bank has various reserves.

| Member Country | Rating* | Authorised Capital | Country's Share |

|---|---|---|---|

| Denmark | Aaa/AAA | 1,763,074,493.79€ | 21.1% |

| Estonia | A1 | 76,651,259.81€ | 0.9% |

| Finland | Aa1/AA+ | 1,482,690,785.19€ | 17.7% |

| Iceland | A1/A+ | 79,132,913.42€ | 0.9% |

| Latvia | A3/A | 111,830,807.21€ | 1.3% |

| Lithuania | A2/A | 163,231,714.80€ | 2.0% |

| Norway | Aaa/AAA | 1,799,704,941.30€ | 21.5% |

| Sweden | Aaa/AAA | 2,892,527,558.59€ | 34.6% |

| Total | 8,368,844,474.11€ | 100.0% |

Governance

Each member country designates a governor for the Bank’s Board of Governors, which is the supreme decision-making body. The Control Committee monitors that NIB’s operations are conducted in accordance with the Statutes. The Board of Directors makes policy decisions concerning the operations and approves the financial transactions proposed by NIB’s President.

NIB’s President is responsible for the conduct of the current operations of the Bank. The President is supported by the Executive Committee; the Asset, Liability & Risk Committee; the Mandate, Credit & Compliance Committee; and the Business and Technology Committee.

Board of Governors

Each member country is represented on NIB’s Board of Governors by a government minister.

Board of Directors

The Board of Directors is composed of eight directors and eight alternates appointed by each member country.

President and CEO

NIB’s President guides the Bank’s operations and chairs the Executive Committee. The Board of Directors appoints the President.

Executive Committee

The Executive Committee is an advisory body to the President. It deals with policy and management issues.

Control Committee

The Nordic Council and the Parliaments of Estonia, Latvia and Lithuania appoint one member from each country.

Milestones

Legal framework and policy documents

NIB is governed by its constituent documents. Our activities are guided by a number of policies, guidelines and instructions adopted by the Board of Directors or the President.

Integrity & Compliance

As an international institution entrusted with public funds, NIB strives to carry out its operations with the highest integrity and in compliance with best practices and its own legal framework.

Explore more

Other committees

Asset & Liability Committee, Mandate, Credit & Compliance Committee, Business & Technology Committee.

Responsible procurement

Rules and information related to the the procurement of goods and services.