We offer sustainable long-term financing that improves productivity and benefits the environment

NIB lends to both the public and private sectors on competitive market terms. Our financing complements other available funding sources and crowds-in additional investments. We carefully assess the impact of our loans, providing a quality stamp for your projects.

Our offering

NIB tailors its financing to match your business needs. We work closely with our clients to tackle complex issues and provide guidance on sustainability matters. Our sectoral expertise, combined with triple-A credit ratings, allows NIB to keep the lending process simple and the terms competitive.

WHAT WE FINANCE

We work towards a prosperous and sustainable Nordic–Baltic region, so the majority of our financing is located within the membership area. Outside the Nordic–Baltic region, we may also finance projects that involve member country interests.

Sectors we work with

Connectivity & Consumer

Transport & communication infrastructure or services, R&D and capital investments or acquisitions.

Anna Kajander

anna.kajander@nib.int

+358 10 618 0324

Industry &

Real Estate

Clean technologies, capacity improvements, efficient use of raw materials, as well as green buildings.

Tony Mäkynen

tony.makynen@nib.int

+358 10 618 0523

Project & Structured Finance

Loans that involve complex risks or financial structures, including the public–private partnership model.

Patrik Marckert

patrik.marckert@nib.int

+358 10 618 0266

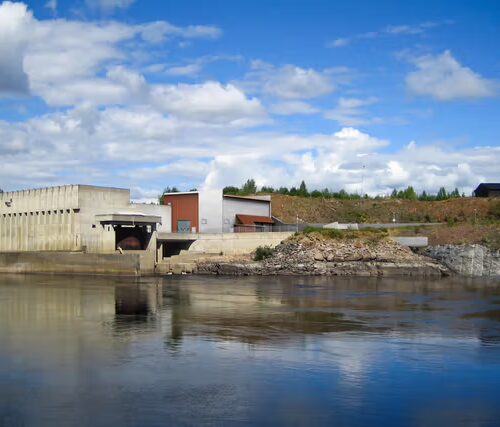

Public Sector &

Utilities

Urban & social infrastructure, as well as investments in energy efficiency and utility services.

Dmitri Kouznetsov

dmitri.kouznetsov@nib.int

+358 10 618 0128

Financial

Institutions

On-lending through financial intermediaries to reach SMEs and small midcaps, as well as MREL lending.

Akvilė Skiparė

akvile.skipare@nib.int

+358 10 618 0485

Client voices

How it works

Financed projects

See the list of loans signed since 2007. Read their project summaries to learn more about the financed investments and their impact on productivity and the environment.

Latest loans

Explore more

Environmental bonds

The proceeds of NIB Environmental Bonds are used for the Bank’s environmental lending

Integrity & Compliance

Good governance, transparency and accountability are essential for sustainable finance